A Spanish mortgage is based on the financial situation of the mortgage applicant as well as the Spanish collateral..

Realise that buying a Spanish property is a different story from buying a Dutch property. Does the property have the right permits? Are the sellers even the legal owners? All sorts of things that are crucial in getting the mortgage. We bring you up to date on some of the things to look out for when buying a Spanish property.

Permits for a Spanish home

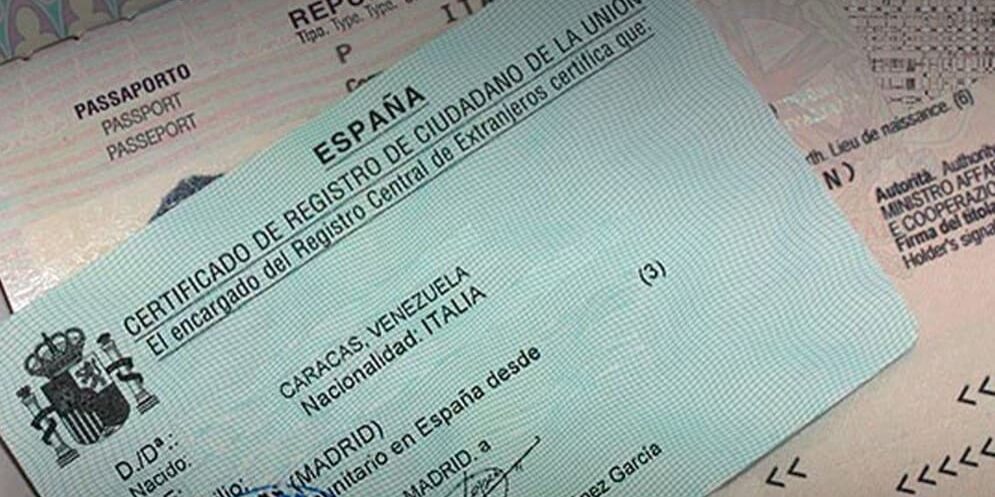

The Nota Simple gives you as a buyer insight into the legal registrations of this property. To qualify for a mortgage, the property must be registered in the Spanish Property Register (Registro de la Propiedad). In addition, you can check whether the seller is also the actual owner of the property. Wondering what else to look out for in a Nota Simple? Then read more about our extensive article about the Nota Simple.

Another important document for buying a property in Spain is the Cedula de la habitabilidad, the residence permit. This permit is issued only if the municipality has approved it and considers it habitable. Without a Cedula, you absolutely cannot get a mortgage from a Spanish bank. You will also face problems with other things, such as applying for a connection for water or electricity.

The difference between an Urban and Rustica home

The Nota Simple or an valuation report refers to what kind of property it is. There are two different types of houses:

an Urban home and a Rustica home. Want to know in detail what the difference is? Then read more about an urban vs rustic property in Spain.

- Urban homes are often located in cities or by the beach (popular places). Here there are often clear zoning plans and necessary permits by the municipalities (municipales)

- Rustica homes are often secluded in quiet villages. You probably guessed it: but the right permits or building regulations for the house are often missing.

If the Spanish bank needs to foreclose on the collateral (when the mortgagee does not pay the monthly rate), it is more difficult for the bank to sell a Rustica property than an Urban property (Urban is often more popular).

This affected many Spanish banks during the crisis period, which is why today few banks want to finance a Rustica home. This is because a Rustica home is a higher risk for the bank. So the type of property also affects the possibilities of financing with a Spanish bank.

Advice from our mortgage specialists:

Are you dreading all the procedures to check all the permits? And the language barrier that undoubtedly rears its head in cases like this? Our advice is to hire a lawyer at all times during the Spanish purchase process. Through our network, we are happy to put you in touch with a lawyer who charges transparent prices and quickly arranges the permits you need.

Know everything about your home purchase?

Then our white paper "buying a property in Spain" is perfect. You can read everything from a-z about pitfalls and steps to buy your dream home here. From Barcelona to Sevilla!